In the ever-evolving landscape of proprietary trading, the importance of licensure and self-sufficiency cannot be overstated. Recent developments indicate a significant shift in the industry’s future, one that prioritizes regulatory compliance and technological autonomy.

At the forefront of this transition is Monevis, a proprietary trading firm that sets a benchmark in both regards. This article delves into the future of the prop trading industry, emphasizing the critical role of licensed operations and the impending challenges for firms operating without such credentials.

The Crucial Role of Licensure in Proprietary Trading

The proprietary trading industry has long been characterized by its dynamic nature and the diversity of its participants. However, not all firms operate on the same level of regulatory compliance, particularly concerning licensure.

The distinction between licensed and unlicensed operations has become increasingly significant, with regulatory bodies and service providers tightening their criteria for collaboration. A licensed firm like Monevis, which boasts a license from MQ, represents the gold standard in the industry.

Monevis: A Paradigm of Autonomy and Compliance

Monevis distinguishes itself by not only holding a MQ license but also by operating its own MetaTrader 5 (MT5) servers. This level of in-house technological infrastructure is noteworthy for several reasons. Firstly, it eliminates the reliance on third-party brokers, thereby reducing the risk associated with external dependencies.

Secondly, by not white-labeling its platform, Monevis retains complete control over its trading environment, enhancing security, stability, and performance. This autonomy in technology and infrastructure underscores Monevis’s pioneering approach in the prop trading domain.

Implications for the Prop Trading Industry

The implications of MQ decision extend beyond the immediate operational challenges for unlicensed firms. This policy shift signals a broader move towards greater transparency, security, and fairness in the prop trading industry.

For traders, it means engaging with firms that are not only committed to best practices in trading but are also recognized by leading technology providers for their compliance and infrastructure.

Licensed firms like Monevis are poised to lead this transition, offering a model that balances technological self-sufficiency with strict adherence to regulatory standards. As the industry moves forward, the emphasis on licensure and in-house technology infrastructure is expected to become the norm rather than the exception.

Conclusion

The future of the prop trading industry is on a course towards enhanced regulation, security, and technological independence. Firms that anticipate and adapt to these changes, prioritizing licensure and technological autonomy, will likely find themselves at the forefront of the industry’s evolution.

As the industry navigates this transition, the role of pioneering firms like Monevis becomes increasingly significant, guiding the way towards a more secure, transparent, and regulated trading environment.

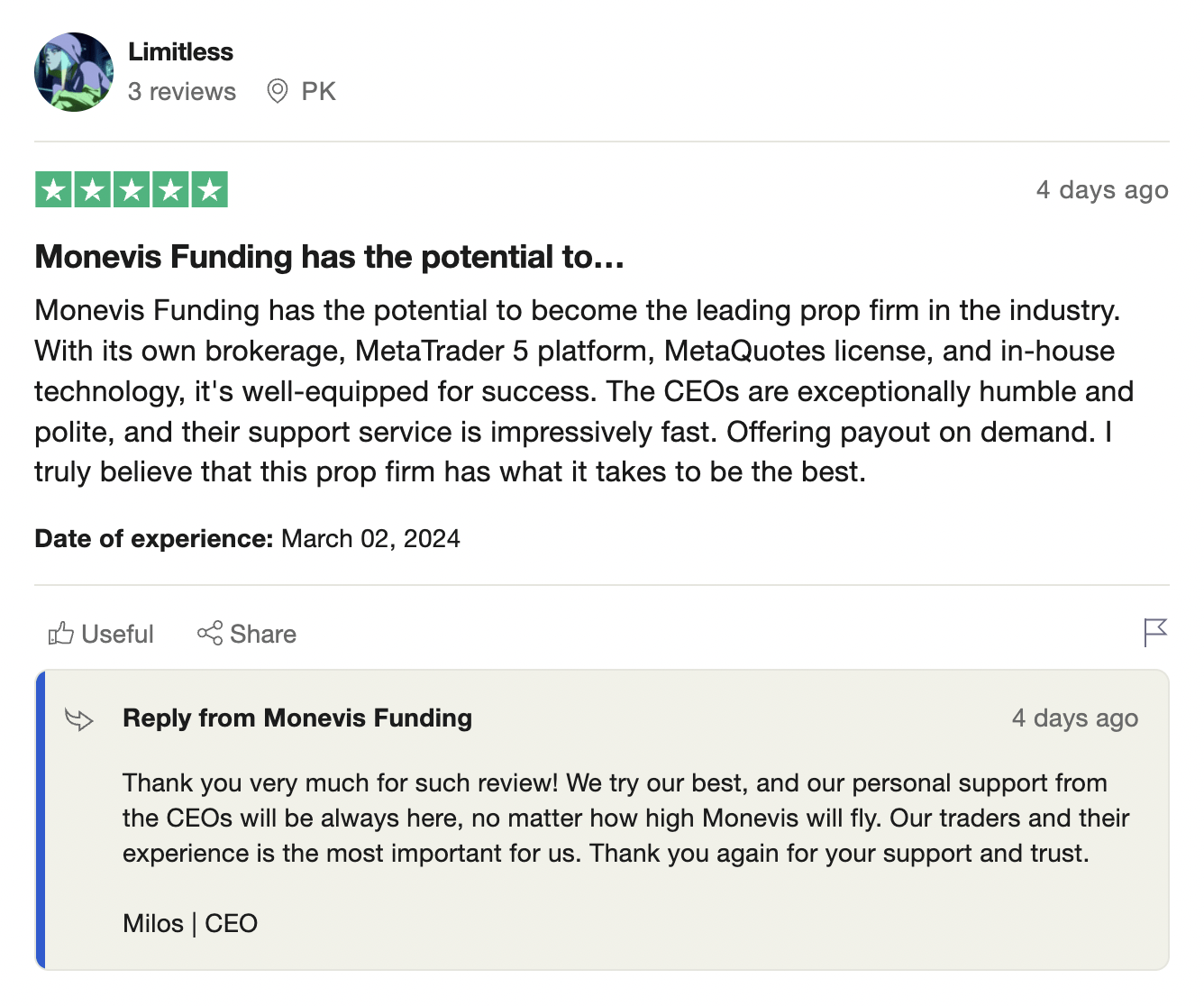

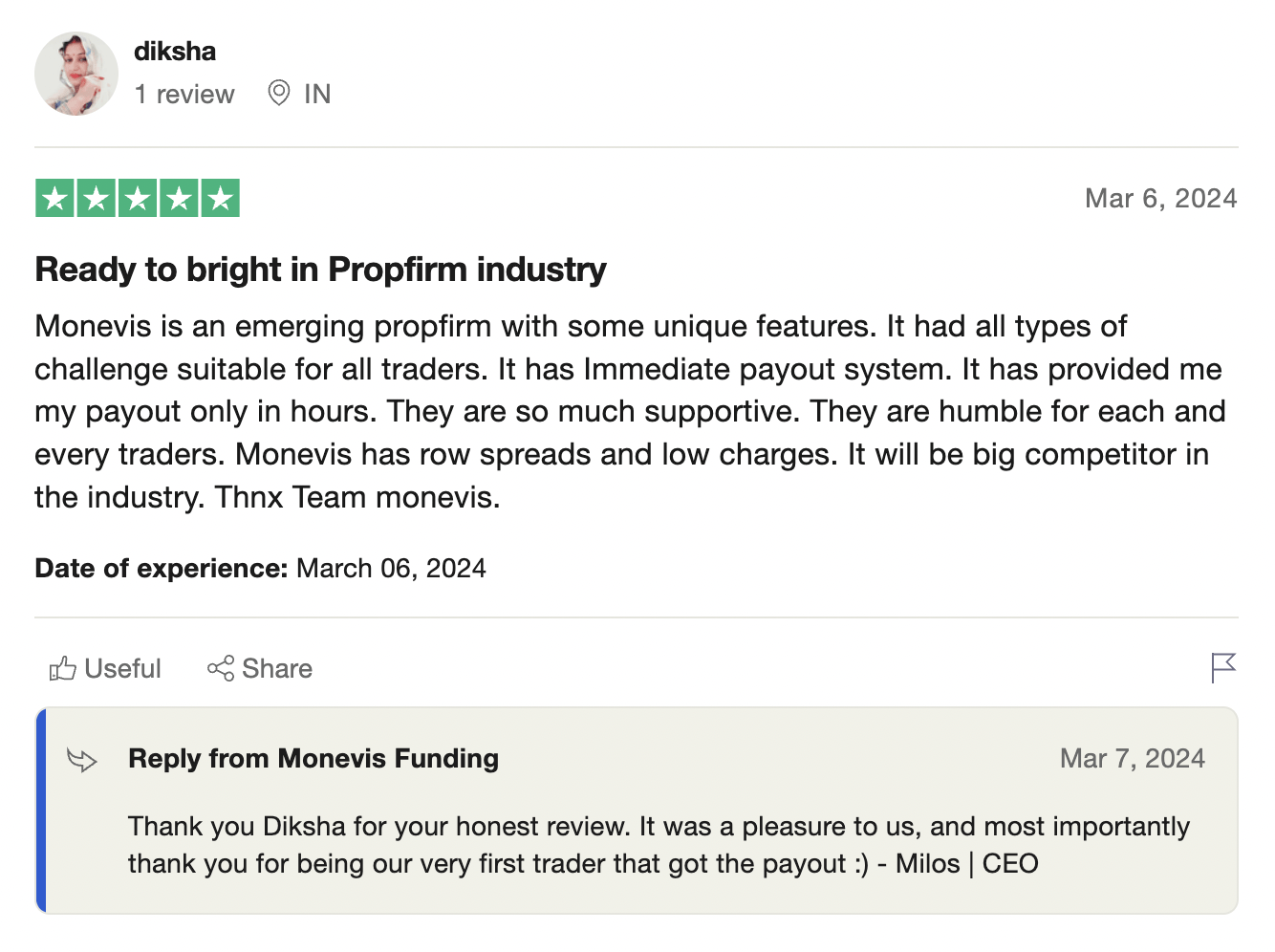

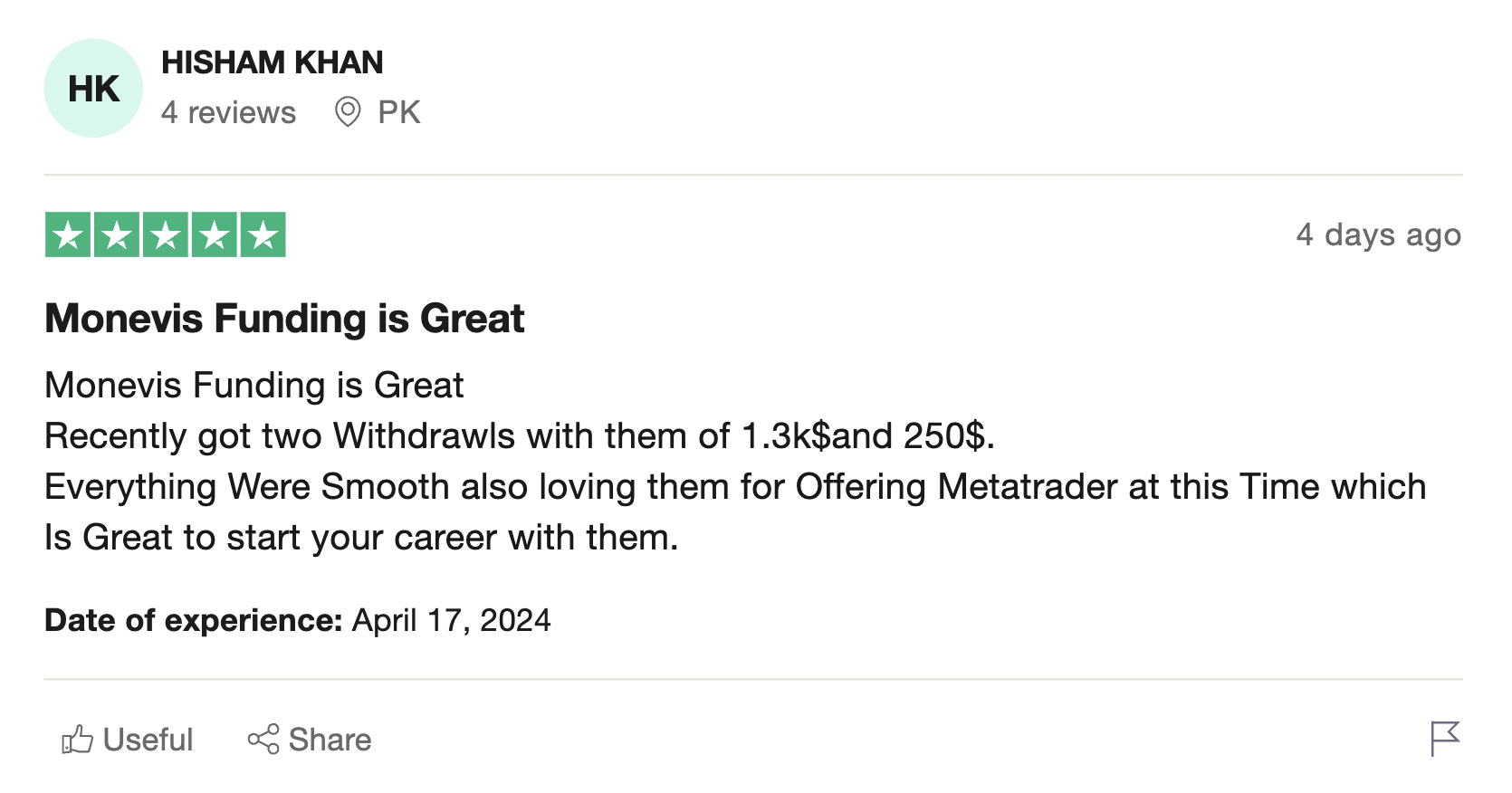

What Monevis’s Traders Say?

(Source: TrustPilot)