SICAK İPUCU: Monevis® ile ticaret potansiyelinizi ortaya çıkarın

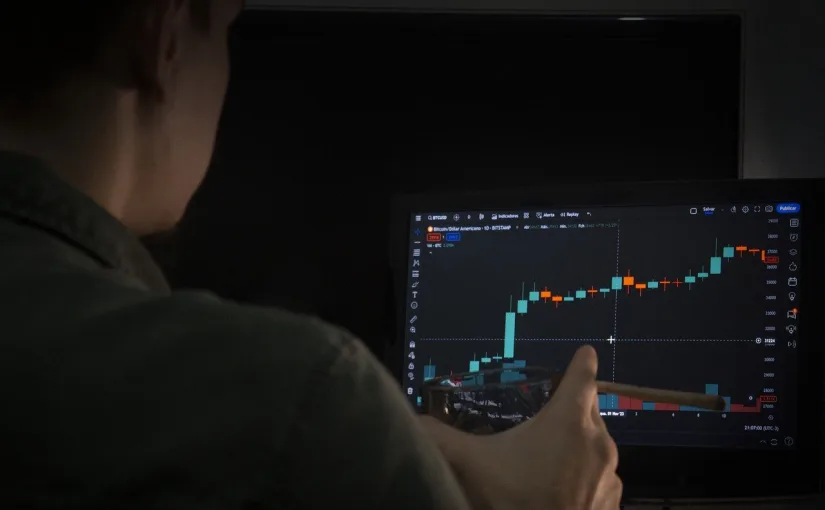

Price Action is one of the oldest and most effective trading strategies, widely adopted by traders around the globe. This approach focuses on analyzing the price movement itself without relying on indicators, allowing for a deeper understanding of market dynamics. Why is Price Action so important, and how can it enhance your trading success?

What is Price Action?

Price Action refers to a trading method based solely on analyzing price movements, candlestick charts, and key support and resistance levels. This approach eliminates most technical indicators and instead focuses on interpreting the market directly, making it a clean and straightforward trading style.

Why Monitor Price Action?

1. A Clear Approach to the Market

- Price Action eliminates the reliance on complex indicators, offering an unfiltered view of the current market situation.

- It helps traders better understand what is happening in the market and identify the actions of major players, such as institutions and funds.

2. Versatility Across All Markets and Timeframes

- Price Action works on all markets (forex, stocks, cryptocurrencies, commodities) and all timeframes (from minute charts to weekly trends).

- This makes it suitable for scalpers, swing traders, and position traders alike.

3. Key Information Directly from the Chart

- By observing Price Action, you can identify critical price levels, trends, reversals, and consolidation areas.

- It allows you to better understand market psychology and participant sentiment.

4. Simple and Efficient Decision-Making

- Price Action simplifies the decision-making process. Instead of being overloaded with information, traders focus solely on what the price itself reveals.

Core Principles of Price Action

1. Candlestick Patterns

Price Action often relies on candlestick patterns, which reflect market behavior. Key patterns include:

- Pin Bar (Hammer/Inverted Hammer): Indicates potential reversal.

- Engulfing Candle: Strong signal of a trend change.

- Inside Bar: Signals consolidation and preparation for a breakout.

2. Key Support and Resistance Levels

- Identifying these levels helps pinpoint areas where price is likely to reverse or break out.

3. Trendlines and Channels

- These tools help determine the market’s direction and potential reversal points.

4. Price Patterns

Commonly monitored patterns include:

- Head and Shoulders: Signals a trend reversal.

- Triangles: Indicate consolidation and an impending breakout.

- Flags and Pennants: Indicate trend continuation.

How to Use Price Action in Trading

- Analyze Candlestick Charts

Focus on patterns and formations that provide entry and exit signals. - Identify Key Levels

Look for areas where price repeatedly bounces or gets rejected and use them as the foundation for planning trades. - Consider Market Context

Analyze whether the market is trending, consolidating, or at critical levels, which will influence your trading decisions. - Combine Price Action with Other Tools

While Price Action is a standalone method, it can be enhanced with simple tools like Fibonacci retracements, volume analysis, or trend indicators.

Pros and Cons of Price Action Strategy

Pros:

- Simplicity and clarity.

- Universally applicable across all markets and timeframes.

- Provides better insight into market psychology.

- Adaptable to various trading styles.

Cons:

- Requires experience and the ability to interpret charts.

- Subjective—different traders may read Price Action differently.

- Not ideal for traders reliant on automation or bots.

Conclusion: Why Price Action Matters

Price Action is a cornerstone of successful trading. Instead of relying on lagging indicators, it allows traders to understand the market in real time and adapt their decisions to current conditions. If you aim to improve your trading outcomes and become a more effective trader, mastering Price Action is a must.

Whether you trade forex, stocks, or cryptocurrencies, Price Action opens the door to deeper market understanding and helps build a consistent trading strategy.

SICAK İPUCU: Monevis® ile ticaret potansiyelinizi ortaya çıkarın