What Type of Trader Are You?

Before you start building your trading system, it’s crucial to decide what type of trader you want to be. Your personality and schedule play a key role in this decision.

Scalpers

Scalping is considered the most demanding approach to trading. Scalpers hold their positions for only a few minutes, sometimes just seconds. It requires maximum concentration throughout the trading session and can be mentally exhausting due to many small losses.

Why choose scalping? The two main reasons are returns and freedom. Scalpers have numerous trading opportunities each day and can trade according to their schedule without having to watch the market after the trading session ends.

Day Traders

Day traders are similar to scalpers, but they usually watch the market all day and hold their positions for several hours. Their approach is calmer, focusing on larger market moves. Although they generally do not hold positions overnight, they sometimes do to capture larger moves.

Swing Traders

Swing traders hold positions for several days to weeks. This style is popular among beginners because it doesn’t require much time for analysis. Swing trading requires patience, as you often wait several days for a suitable trading opportunity. Positions held for longer periods can cause stress due to significant price fluctuations.

Position Traders

Position traders, often called investors, hold their positions for weeks, months, or years, tracking long-term trends. This style requires significant capital and is more suitable for experienced traders.

Choosing the Right Market

The market you choose depends on the type of trader you are. Swing traders often trade on multiple markets simultaneously, while day traders focus on one or two markets. Each market has its specific characteristics and moves at different times. Thoroughly studying various markets and their movements is crucial for success.

Trading Capital

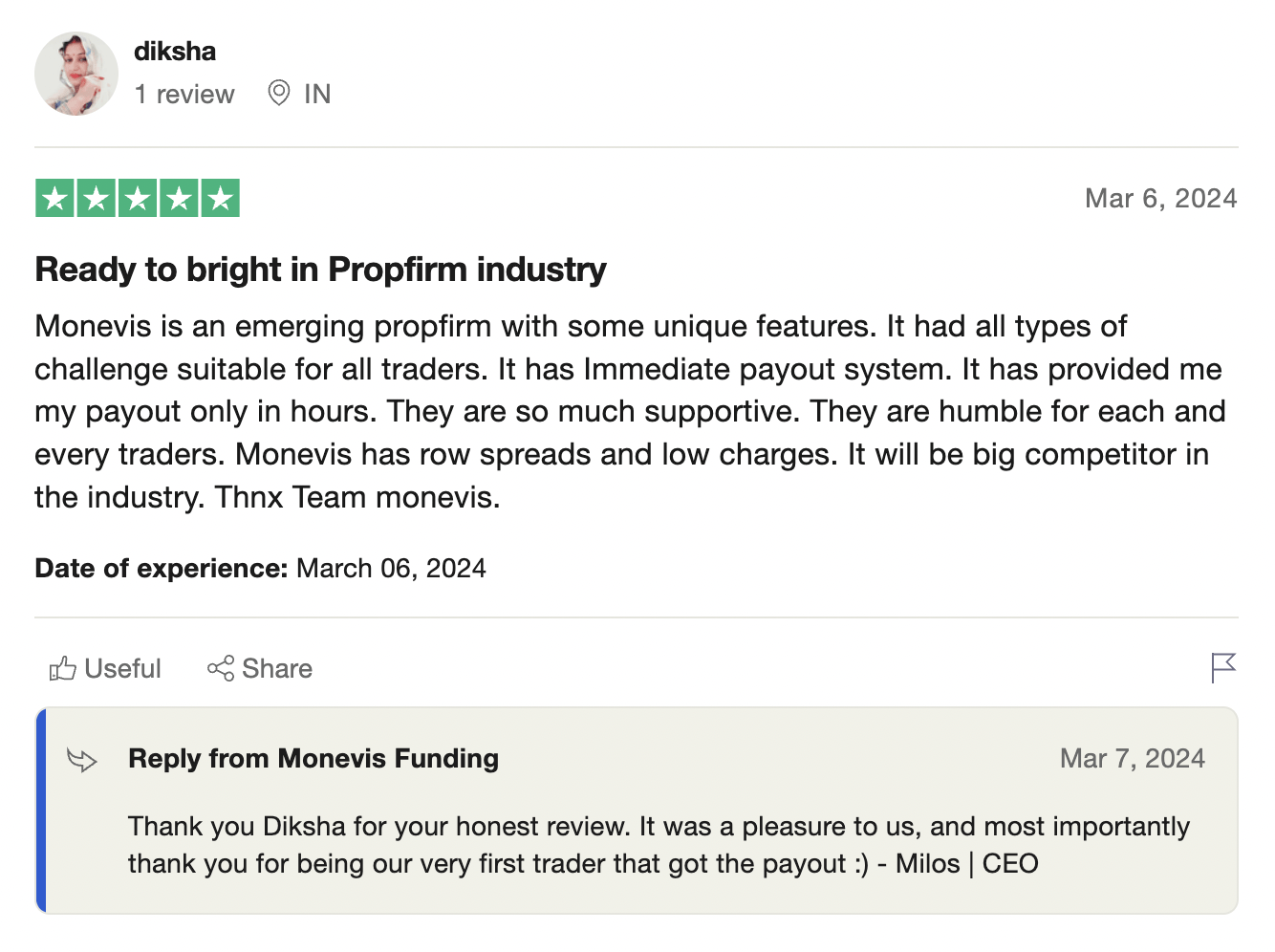

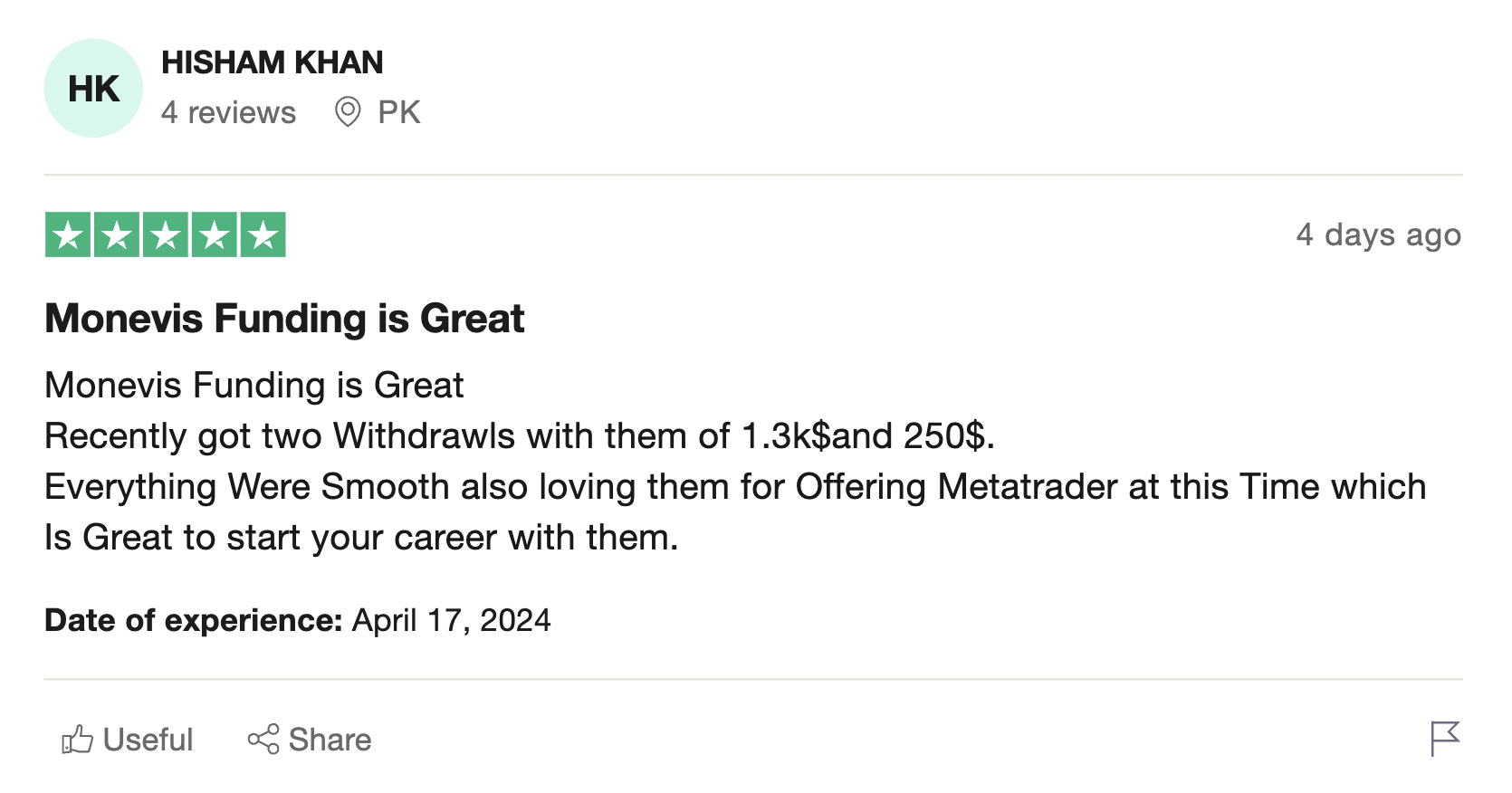

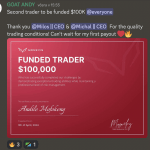

Trading capital is an important factor. You can have a great strategy, but without sufficient capital, it’s challenging to achieve significant profits. Monevis helps experienced traders with capital shortages by providing financial resources up to $400,000, if they pass the evaluation process.

Ticaret Stratejileri

Your trading strategy can be technical or fundamental. Technical analysis is popular among retail traders, while fundamental trading focuses on news and economic events. Discretionary trading relies on your judgment, while systematic trading is based on clearly defined rules.

Sonuç

Becoming a professional trader is not easy, but it is possible with enough determination and experience. Trading is a business like any other and requires a robust trading strategy, a trading journal, and constant market monitoring. Monevis is here to help you achieve your goals.